We believe that now is a seminal moment for investment in United States infrastructure.

With significant infrastructure assets beyond their useful life in cities and states across the country, now is the critical time for the US to invest in infrastructure as it did over 60 years ago through investments in highways, ports, and public buildings.

Phoenix Infrastructure is poised to drive innovative investment in an asset class that stands at the nexus of paradigm-shifting technology, changing demographics, urbanization, and the inefficiency of the traditional public finance model.

Investment Strategy and Guidelines

Phoenix Infrastructure pursues investment opportunities in North America along the following guidelines

Infrastructure Defined

Long-term investment opportunities for public assets or ownership opportunities for private assets and companies with inelastic characteristics

Investment Criteria

Targeted IRR low to mid-teens; Minimum 7-year targeted term; representative voting and control within consortium co-investment opportunities

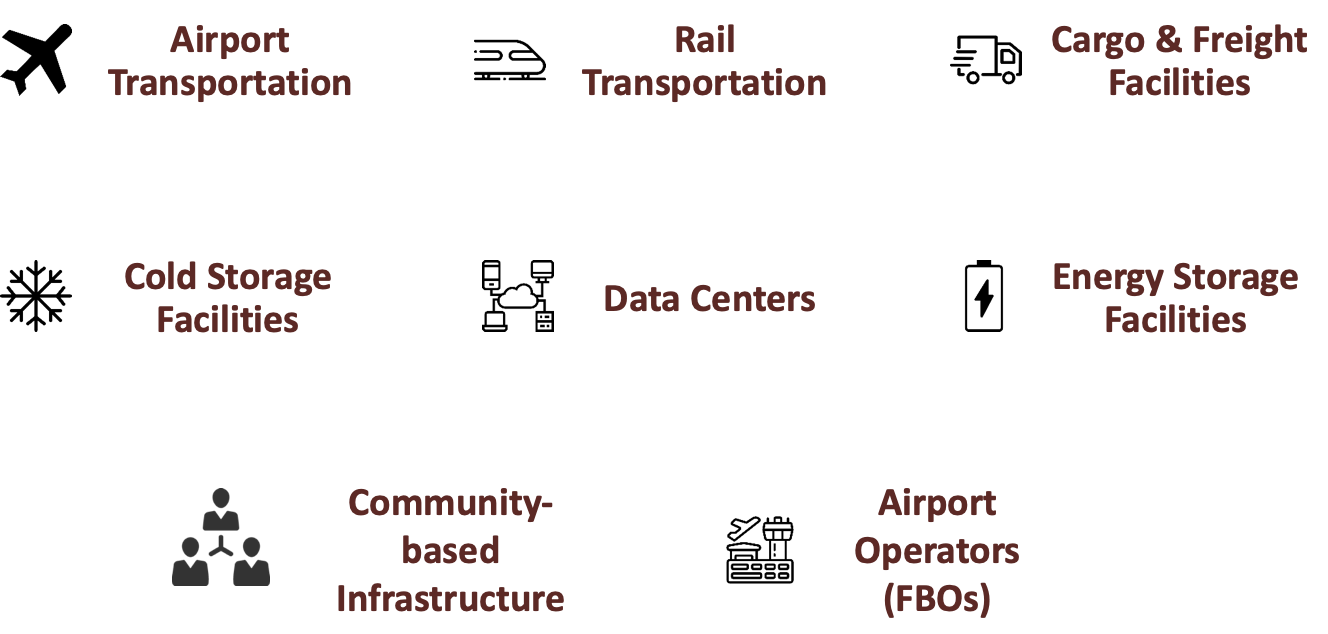

Targeted Asset Classes

Pursuit of the highest values of excellence, deepest levels of diversity and strongest levels of community engagement in our pursuits.

Environmental, Social and Governance (ESG)

Commitment to advance the UN’s Sustainable Development goals in our platform and every potential project. Support for investments that promote fair labor standards and goals.

We invest in projects that reflect and advance the communities that they impact. We believe that a successful approach to development must reflect a multitude of viewpoints and preferences, including those who may not traditionally hold the most economic or political power.

MBE Participant

Our role as an Minority-Business Enterprise (MBE) will serve as a competitive advantage towards pursuing and participating in deals. Most municipalities have stipulations requiring MBE participation in. As one of the few MBE infrastructure investment firms in the US, we seek to leverage this opportunity to add-value in opportunities other firms may not be able to.

Co-Investment Role

We seek to engage our strategic partners across investor and development functionalities to source, pursue and participate in investments. Leveraging our agile platform, local contacts, MBE qualifications and industry experience and presence in the market, we will engage partners for co-investment opportunities.

Sole/Lead Investor

We will seek opportunities as a lead investor for primarily middle-market opportunities. In this role we will source deals from the primary as well as secondary market of infrastructure investments across a variety of sectors.